Foreign Land Ownership vs. U.S. Ownership

Foreign Land Ownership vs. U.S. Ownership: Incentives, Taxes, and Policy Questions

Foreign Land Ownership vs. U.S. Ownership: Incentives, Taxes, and Policy Questions

Land is more than soil and trees—it is wealth. Foreign Land Ownership vs. U.S. Ownership security, and strategic power In the United States, land ownership is often seen as a cornerstone of independence, yet the balance between domestic and foreign ownership has raised new debates. While U.S. landowners benefit from specific tax breaks and incentives, foreign ownership continues to grow, creating both opportunities and risks.

U.S. Land Ownership

The largest landowners in America are families, ranchers, timber companies, and conservation-minded investors. These domestic owners benefit from a number of tax breaks, such as:

Agricultural subsidies for farming and ranching operations.

Conservation easements, which allow landowners to lower property taxes in exchange for preserving their land.

Capital gains benefits when land is transferred or sold under certain conditions.

Property taxes in the U.S. are set at the state and local level, and they vary widely. Rural land often comes with a lower tax burden, making it easier for large-scale ownership to remain profitable.

Foreign Land Ownership in the U.S.

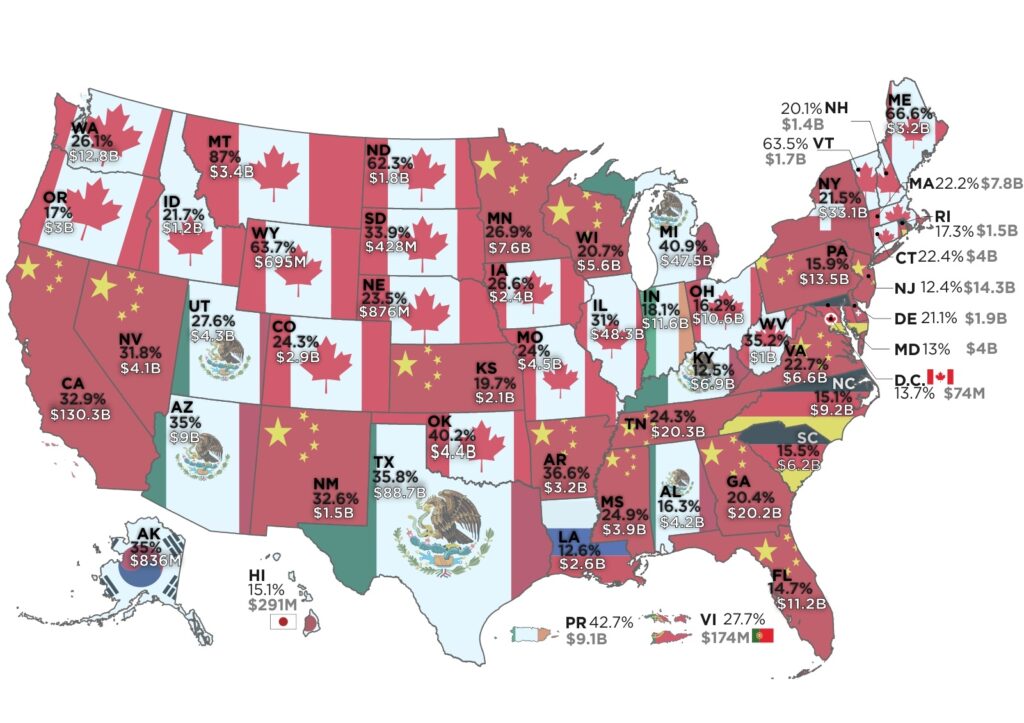

Foreign ownership of American land has steadily grown over the past few decades. Canada leads the way, followed by investors from the European Union and Asia. In fact, Canadian investors own about five times the amount of land in the U.S. as American owners Top 10 in USA.

The imbalance is striking—while Canadian companies and individuals have strong positions in American agriculture and timberland, the U.S. owns virtually no land north of the border.

Foreign investors typically purchase land for:

Farming and ranching operations.

Timber and natural resource development.

Speculation and long-term value appreciation.

Incentives and Tax Breaks Compared – Foreign Land Ownership vs. U.S. Ownership

Both U.S. and foreign owners often receive the same tax treatment inside America. Foreign corporations or individuals who buy farmland or timberland usually qualify for the same property tax rates and conservation benefits as U.S. citizens.

Other countries, however, tend to have stricter rules. For example:

Canada has imposed restrictions on foreign buyers in housing markets and has considered extending this to farmland.

Australia requires government approval for large-scale foreign land purchases.

The European Union maintains mixed policies, with some nations requiring special approval.

This difference creates an imbalance where foreign entities enjoy the benefits of U.S. tax policy, while American investors face restrictions abroad.

Property Taxes

Property taxes in the U.S. serve as a reliable source of revenue for local governments. Importantly, foreign landowners are taxed at the same rates as domestic owners. This means that while foreign owners contribute to local budgets, they can also benefit from relatively low rural property tax rates compared to urban land.

By contrast, some countries apply higher taxes to foreign-owned land or impose restrictions on its use. This again highlights the contrast between U.S. openness and other nations’ protective approaches.

Risks and Benefits – Foreign Land Ownership vs. U.S. Ownership

Benefits of Foreign Ownership:

Brings in capital for development.

Supports infrastructure, farming, and timber operations.

Raises land values, benefiting sellers.

Risks of Foreign Ownership:

Can reduce U.S. control over food supply and natural resources.

Creates potential security issues, especially if land is near military sites.

Profits may leave the U.S. instead of circulating domestically.

Policy Debate

The growth of foreign land ownership has sparked debate across the U.S. Some lawmakers argue that restrictions are needed to protect food security and national security. Others suggest higher taxes for foreign investors to balance the playing field.

Proposals at the state level range from bans on purchases near military bases to added reporting requirements for foreign buyers.

Our Take:

Land ownership is about more than acreage—it represents independence, security, and control over resources. The current comparison between U.S. and foreign ownership shows an imbalance in incentives, tax policy, and opportunity.

The Canada example—where Canadian investors own five times the land Americans hold in USA.— illustrates the imbalance clearly. As the U.S. considers its policies, the debate over how to balance openness with sovereignty will continue to grow.